The profound influence these investment icons have had on our firm and philosophy.

Transcript

Wisdom from Buffett, Munger & Graham

When I think of the investors and the teachers that have influenced me the most over my career, I think that list has to start with Ben Graham. Ben Graham was the father of value investing. He literally wrote the book, Securities Analysis, and then followed it up with the wonderful book, The Intelligent Investor. And both of those contain so many of the fundamental investment lessons that serve us today and that all investors should read and understand.

And then you think of Ben's most famous disciple, of course, it was Warren Buffett. And Warren was able to articulate Ben's wisdom in a way that is easy for people to understand. He developed a folksy way of explaining complicated processes and in that way was such a gifted teacher.

But if you were to ask me this particular lesson that I think about the most from Warren Buffett, it's not just the Ben Graham concepts, it's really the idea that he represents his shareholders in a position of deep trust. In other words he communicates with them as partners. He sees himself as a steward of their savings. And he imbues everything he does with a sense of enormous responsibility to those who have entrusted him with their savings. I think that is a powerful lesson to take away and central to the way I think about our firm and our responsibility.

And I think maybe if put all of these lessons together and think about the one overarching lesson that in a sense frames them all it came from Charlie Munger. And Charlie Munger told me when I was first starting, he said that your goal should be to live and work in a web of earned and deserved trust. And he said there's no substitute for the quality of life, the value that you can create, if you're able to earn and deserve the trust that's placed in you.

More Videos

Davis Advisors: Proven Active Management

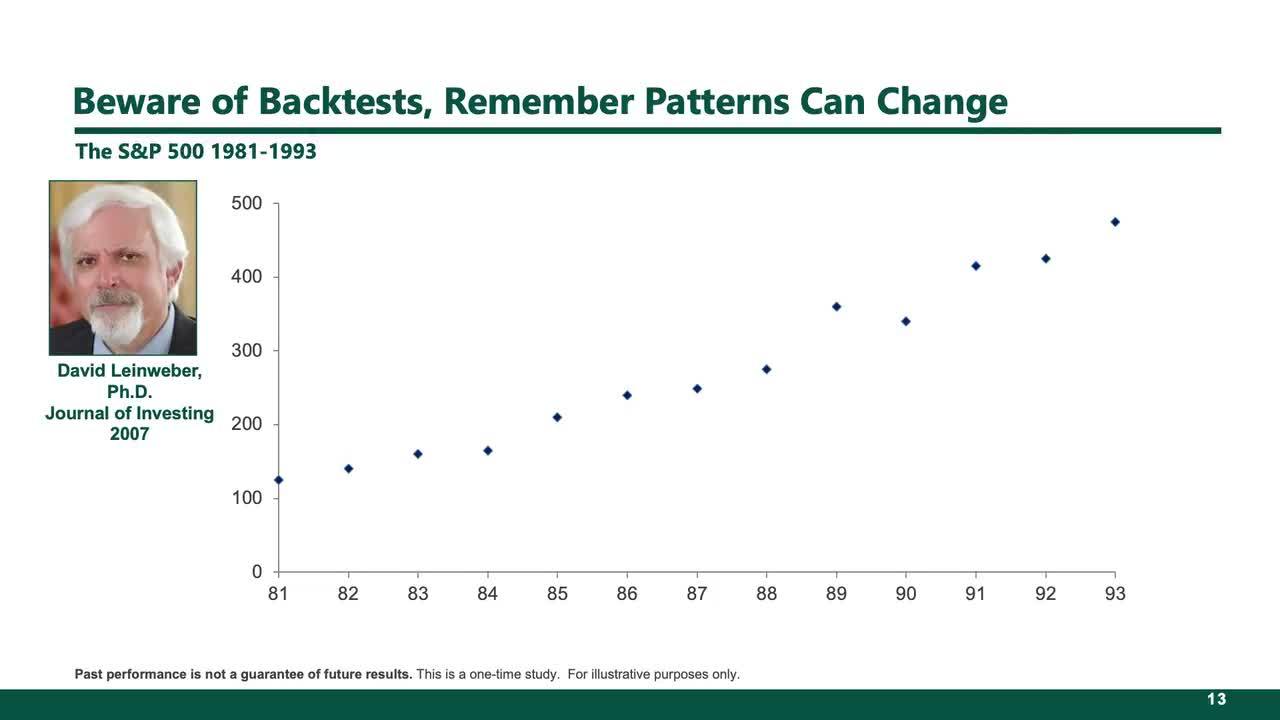

Correlation Does Not Equal Causation