Why we believe selectivity is more important in a time of great market and economic transition and highs in both market concentration and valuations

Transcript

Chris Davis:

Every fall, Danton and I sit with our Board of Directors and it's a time we look forward to because they bring perspectives from all different parts of the economy. Some were CEOs of Fortune 500 companies or CFOs, some were in real estate, some were in engineering construction, uh, in finance insurance. And it's really an opportunity where we sort of set themes and look out at what's happening across the whole economy and what we're seeing unfold in the market in general. And as we came out of this dinner and were synthesizing the information the next morning, Dan and I really realized there were two themes working at once, and they sound contradictory at first. Now, the first theme is that we've come to a definitive decisive end of this era of complacency, this era of free money, this era of magical thinking.

We live through more than a decade where interest rates approach zero for the first time in human history where companies had endless financing could make hyped or over-promised dreams and anything could get financed.

And meanwhile, we had a government that could spend with no repercussions, falling interest rates, greater deficits, falling taxes. All of this was culminating in some pressure that had to give.

And we think the turning point started in March of 2022. That's when that bubble began bursting, but it's still rolling slowly, like a steam roller through markets in the economies. We saw it in commercial real estate. We've seen it in some of the liquidity driving, drying up for IPOs, for private equity, for venture capital. So we feel strongly that we are in a time of great transition in the economy, in monetary policy, in fiscal policy, in inflation, in labor costs, and also in technological disruption with this advent of AI, a huge amount of transition.

So think of that risk transition in the economy as theme one. Theme two is all of this risk and transition and uncertainty is coupled with enormous market complacency and very high valuations and very high concentration in narrow parts of the market.

And that complacency is something that we should really focus on And when you think about it in terms of momentum, momentum investing, people wanting to concentrate and the stuff that has already gone up and it's already continues to go up, that's where they feel safe.

Well, momentum is a bet that past trends will continue. And that bet is not rational in a discontinuous time. So when we couple a narrow market with selective, very high valuations, momentum investing with this massive economic transition and that tension creates a very narrow opportunity set. And that is the investment take away from these two themes, is investors need to focus very narrowly.

Because when you look at the market concentration and momentum, usually that creates great opportunity to swing to value, to look at the value side of the market if relatively few companies are very highly valued relative to the rest of the market, usually that's a good time to swing to value. But when you couple it with the transitions in the economy, rising labor costs, inflation, uncertain economic prospects, then you realize that general swing can be dangerous because many historically bulletproof models are really at risk now. Think of what's happened to companies like IMBAV or what we've seen recently with companies like Estee Lauder or some utilities.

A lot of safe havens have proven not to be so safe. So, that really creates the opportunity set. And, Dan and I came away from that dinner really realizing that selectivity and narrow focus are going to be the keys to navigating this unusually complex time.

Danton Goei:

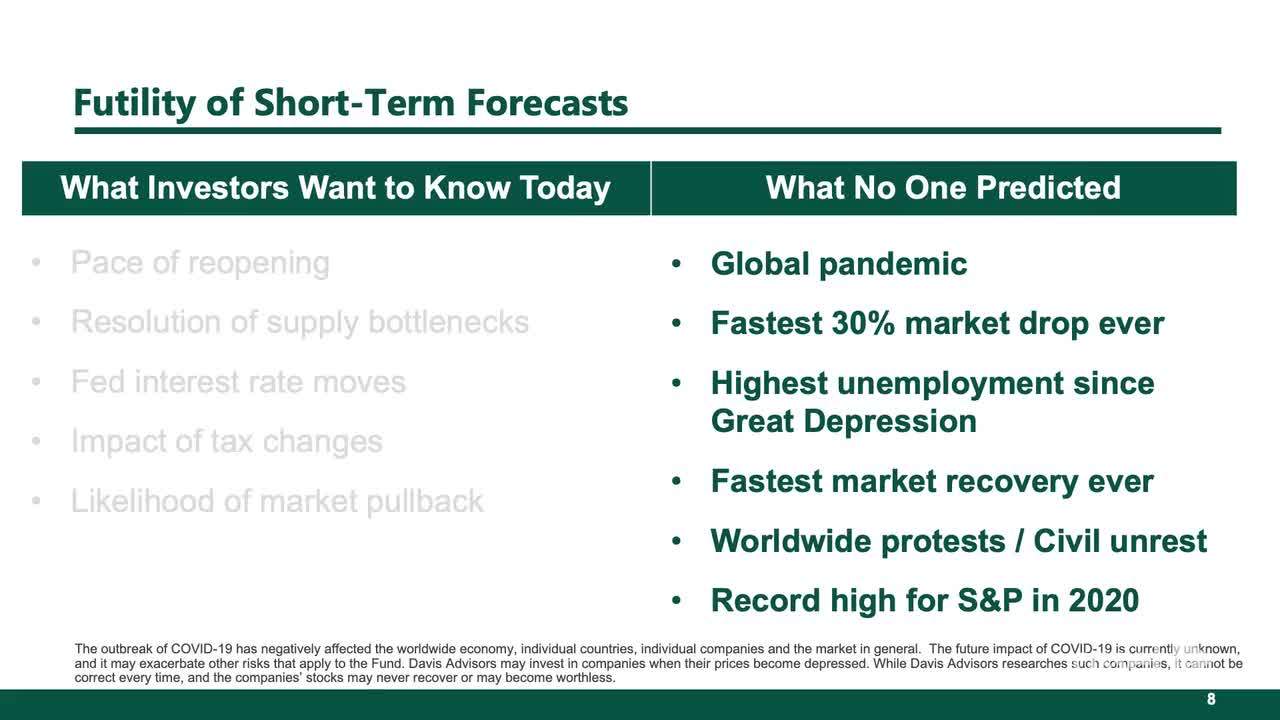

Now, understanding where we are in the macro environment is hugely important, but we are not, you know, thinking and depending on macro forecasts. We are really believers that investing is the art of the specific, and you want to do your fundamental bottoms-up analysis.

And so when we think about what are we looking for to build a portfolio, we want to look at three major things. One, of course, is the quality of the business. Does the business have a moat, right? Does it have a competitive advantage that is durable and resilient? Is it profitable? Is it cash-generative? Does it have a strong balance sheet? Those are all hugely important. Secondly, we look at the quality of the management team.

It's an experienced, obviously, are they honest? And also, are they shareholder focused? Is that their focus? Or are they focused more on sort of empire building and things like that? So quality management is also very important. And finally, of course, valuation. There's no such thing as a must buy, really focused on valuations, hugely important. And so we spend a lot of time understanding what is the price that you're paying today? what is being discounted in the market. And then if you look at today at our portfolio and think about what we're trying to build, we really see the benefits of this approach. So selectivity is the first thing that we focus on. We think of, you know, look at the market, 500 stocks out there, we reject more than nine out of 10. And we have a very high bar, right? These are the things that we're looking for. They're not in every company and so we have to really be selective in choosing the names of our portfolio If you think about also the growth rate We want to have a also companies that grow over time and so we've managed to put together a portfolio of companies That are growing at or even above market rates and are also trading at a significant 30 to 40% discount to the market so this This very selective group of companies with good growth prospects and rates, and then also trading at a very big discount to the market, augers very well for future returns.

More Videos

Incorporating DUSA in a Portfolio Allocation (1:44)

Tuning out the Tweets