The ever-expanding margins and valuations of the past decade are unlikely to be sustained

More Videos

Predicting vs. Preparing, Navigating Sticky Inflation & High Valuations (4:19)

In a world of significant transformation, it's not about risk on / risk off. It's about aligning with durable, adaptable, growing businesses and not overpaying

Watch Now

Strategies to Mitigate the Investor Behavior Penalty (3:40)

The most common and damaging investor penalty comes from rushing in at euphoric high prices and panic selling at the lows. Here's a real alternative.

Watch Now

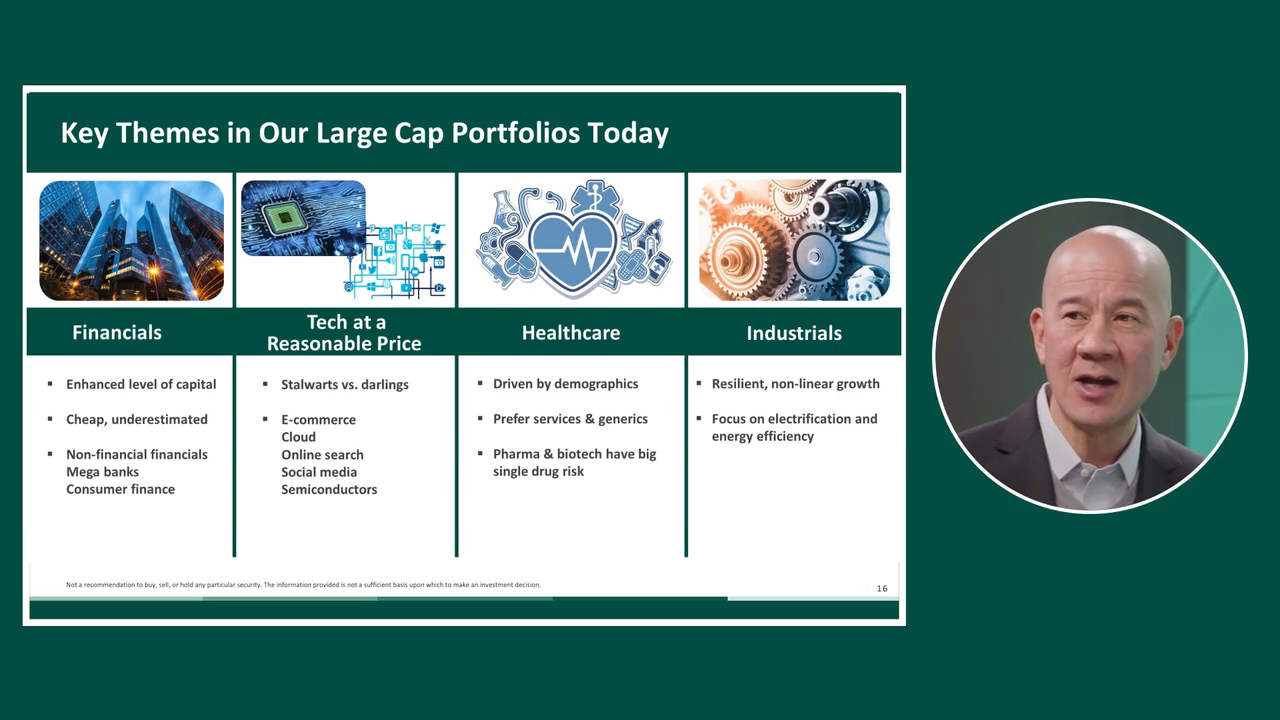

Investment Themes We’re Focusing On Today

Why we’re focusing on select opportunities within Financials, Tech at a reasonable price, Healthcare and Industrials

Watch Now