Identifying vulnerable companies in both the Value and Growth camps – each dangerous in their own ways

More Videos

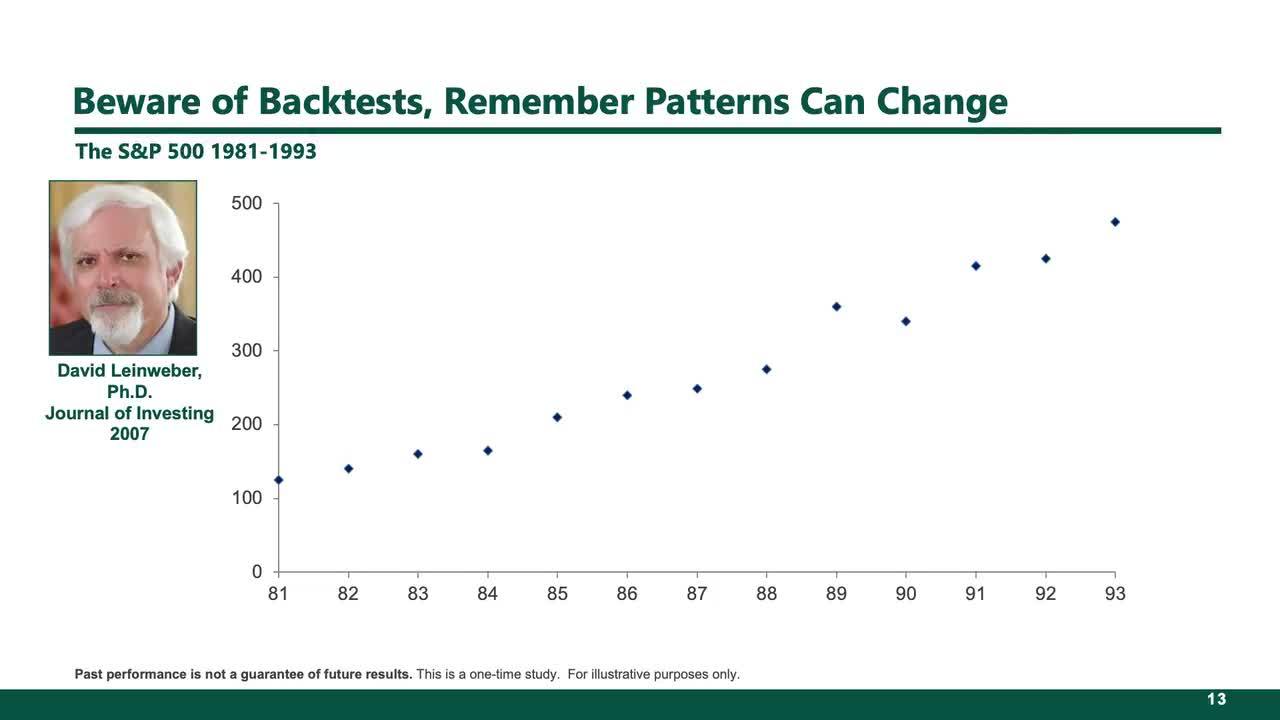

Correlation Does Not Equal Causation

The danger of investment products built on back testing. Markets continuously evolve and factors that seemed to have worked in the past may not work going forward.

Watch Now

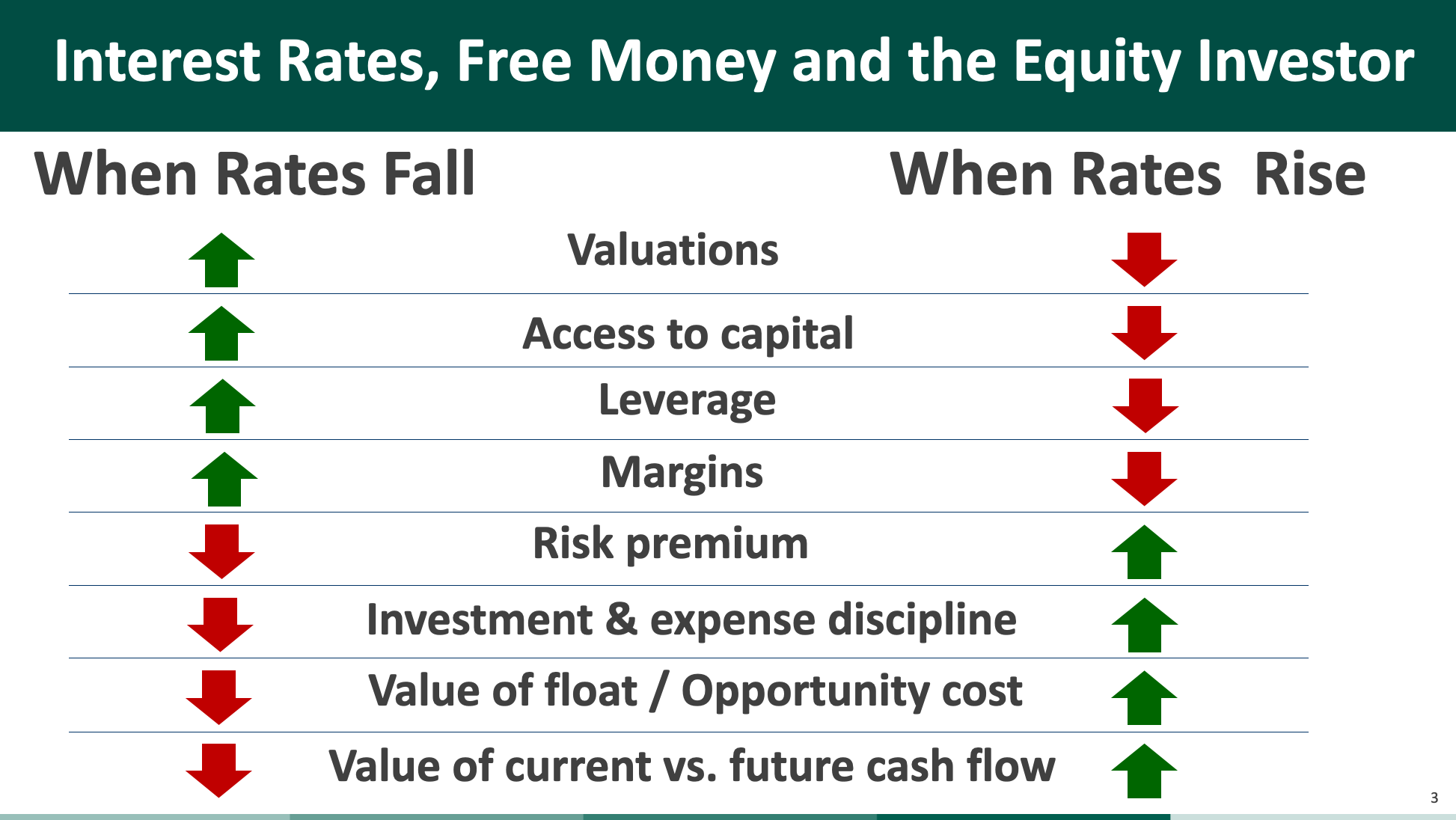

How Investors Should Prepare for the End of the “Easy Money” Era

As rates normalize, certain business models are going to be severely challenged. What kind of companies do you want to own?

Watch Now

Investor Implications of Rising Rates

How the end of the free money era is ending the distortions of the past decade and returning rationality to the marketsv

Watch Now