Consuelo Mack interviews PMs Chris Davis and Danton Goei on the key advantages of active management within an equity ETF: Rigorous research, high conviction stock selection, a portfolio distinct from the index, low costs, tax efficiency, transparency, intraday liquidity

More Videos

Electrification, Teck Resources & the Supply / Demand Mismatch in Copper (3:25)

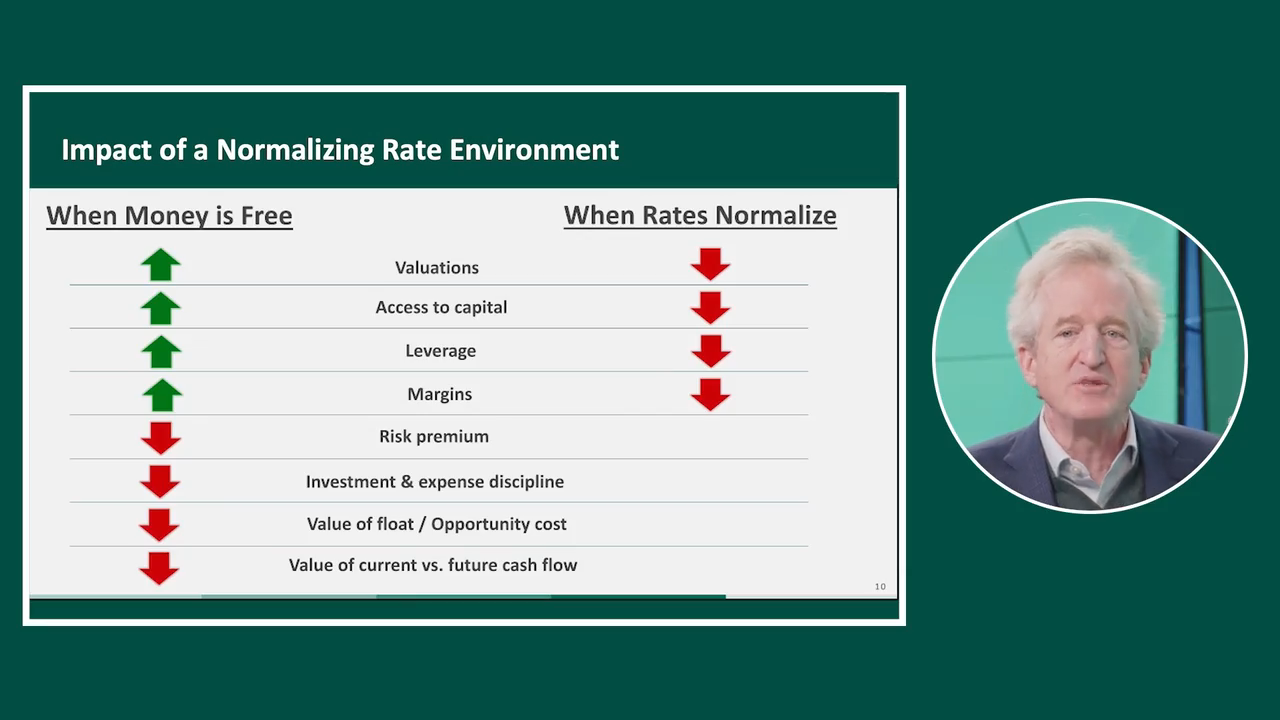

Investing in a Transitioning Market