The danger of investment products built on back testing. Markets continuously evolve and factors that seemed to have worked in the past may not work going forward.

More Videos

Barron's Interview: Risk May Not Be What You Think It Is

PM Chris Davis offers perspective that can help every investor.

Watch Now

Davis & Goei: Actively Managed ETF Pioneers

Consuelo Mack interviews PMs Chris Davis and Danton Goei on the key advantages of active management within an equity ETF: Rigorous research, high conviction stock selection, a portfolio distinct from the index, low costs, tax efficiency, transparency, intraday liquidity

Watch Now

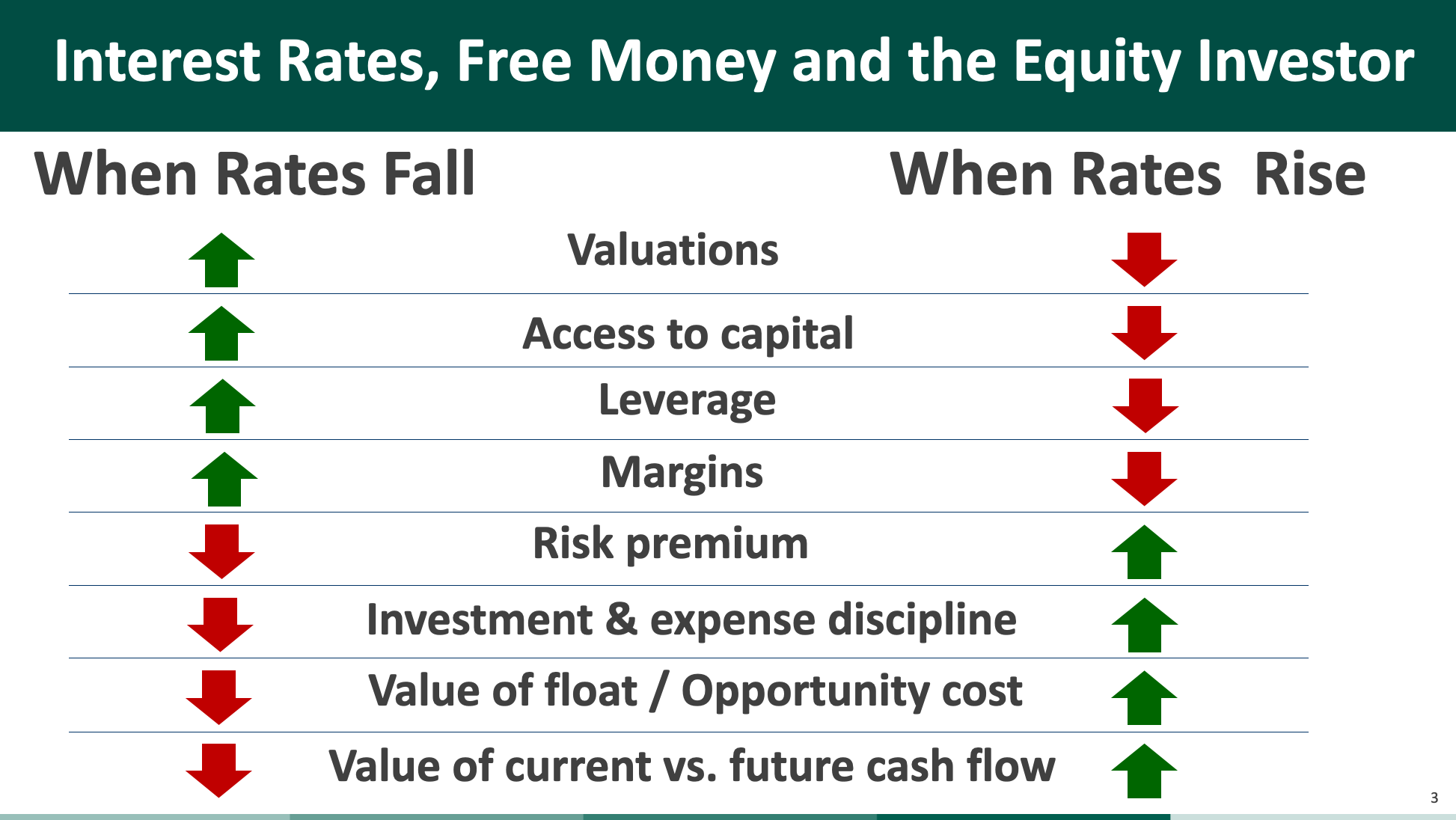

Investor Implications of Rising Rates

How the end of the free money era is ending the distortions of the past decade and returning rationality to the marketsv

Watch Now