PM Chris Davis offers perspective that can help every investor.

More Videos

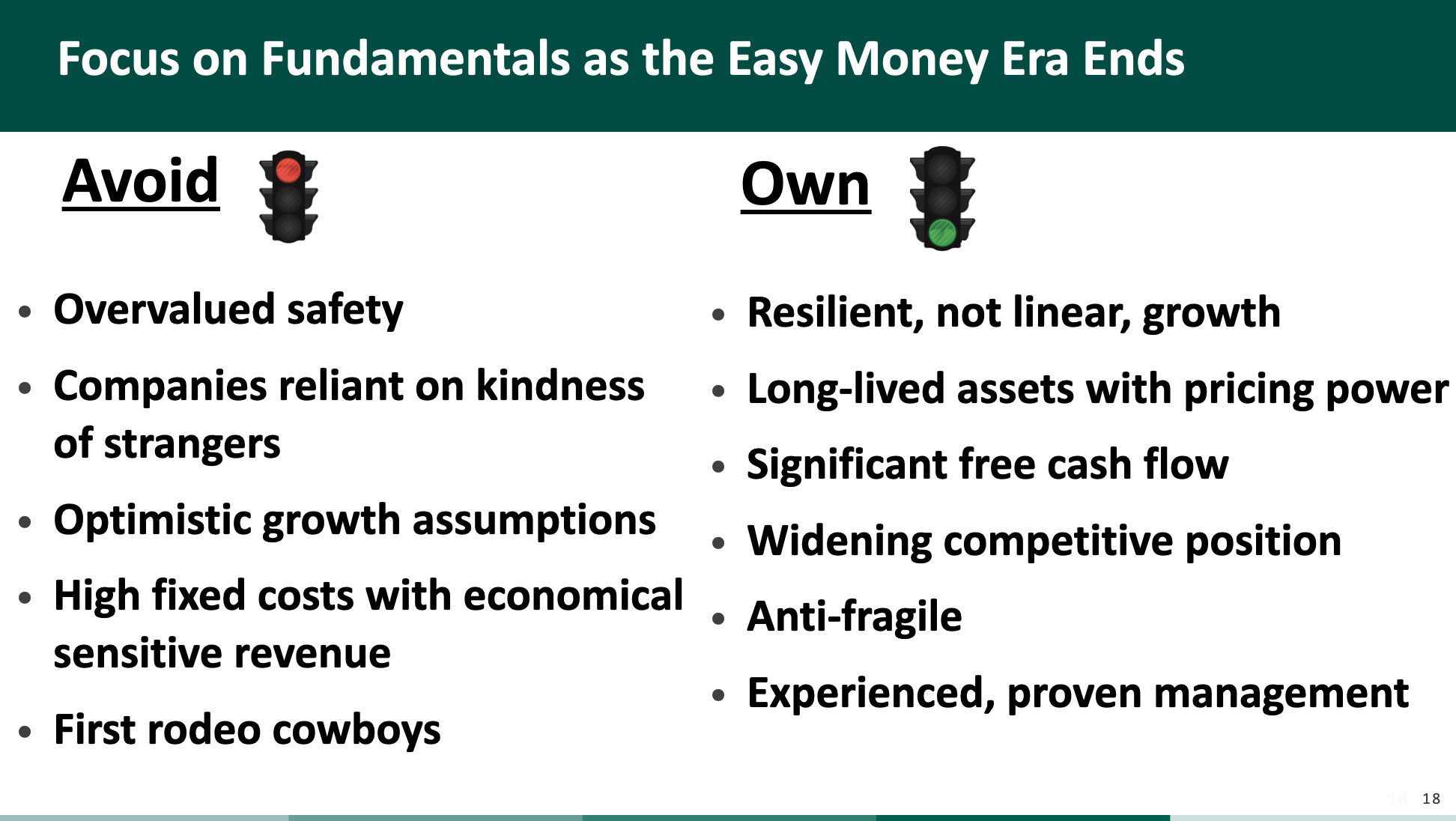

The Most Important Things We Believe Equity Investors Should Focus on Today (6:18)

Key Considerations When Placing ETF Trades