Look for the same characteristics in an investment manager that you'd look for in a company: a track record of execution, resilience, adaptability to change

Transcript

Chris Davis:

When investors choose an active manager, I think it's important to look for the sorts of characteristics that we look for in the companies that we invest in.

In other words, when we invest in an individual company, of course, we're thinking about the durability of the business. How long have these guys been around, right?

And then we're also thinking about an alignment of interests and we're thinking about why 10 years from now, 20 years from now, this company could continue to build wealth in the future. as they have in the past. So let's put some thought in detail behind that idea. So when we think about people stepping into markets today, of course a lot of people choose indexes and that's their own choice, but it seems odd to us to automatically put the most money in what's gone up the most, right ? It's worked well for periods of time, but we have a focus on being selective. And the reason we have this mindset is that we're aligned with our clients.

We're investing our money aligned alongside theirs. So we don't simply want to fire a broad-based can of spray paint at the market owning a little of everything.

We want to try to focus on those types of businesses that can build wealth for the long-term. So we think by eating our own cooking, by being largest investors in the funds and strategies that we manage by having our compensation tied to long-term shareholder returns, by focusing on businesses that we can own not just for a quarter, not just for a year, but own for years and even decades, that we can put together a selective portfolio of companies that can build wealth for the long term. And we think when investors look to get in the market at an unsettled time, that focus on durability, resilience, and I'll add one final word, adaptability, because we've been doing this for over 50 years. And that's meant we've had to adapt to changes in the market, changes in the economy, changes in technology, changes in monetary policy, fiscal policy, political uncertainty, unrest, geopolitics.

Well, we know that the next decades are not going to be that different from the last in terms of unexpected disruptions.

You have to be prepared, you have to be resilient, and you have to be able to adapt. Those are the characteristics and the traits that we bring to our clients and that are sort of the hallmarks and pillars of our investment discipline.

More Videos

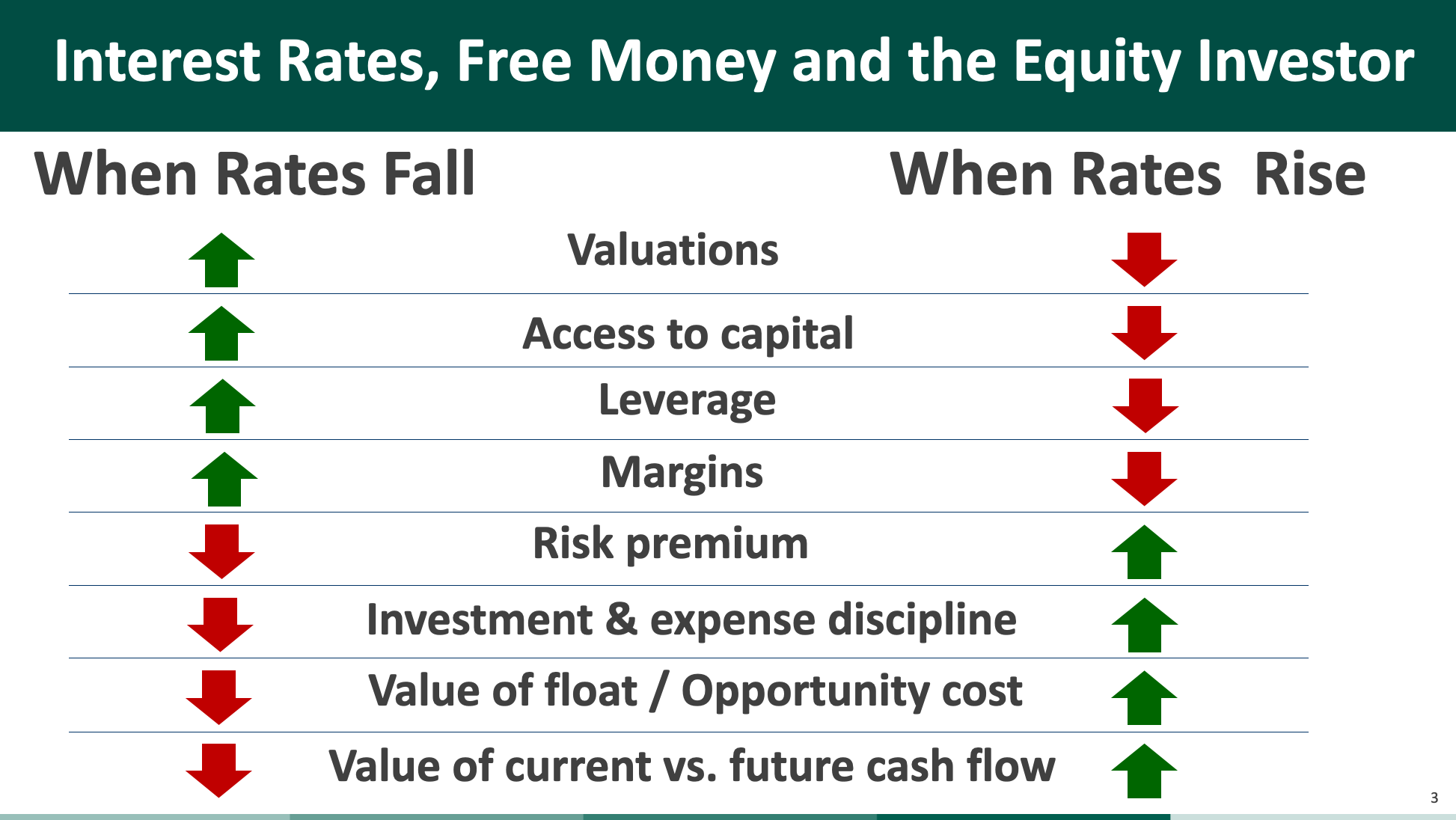

Investing in a Transitioning Market

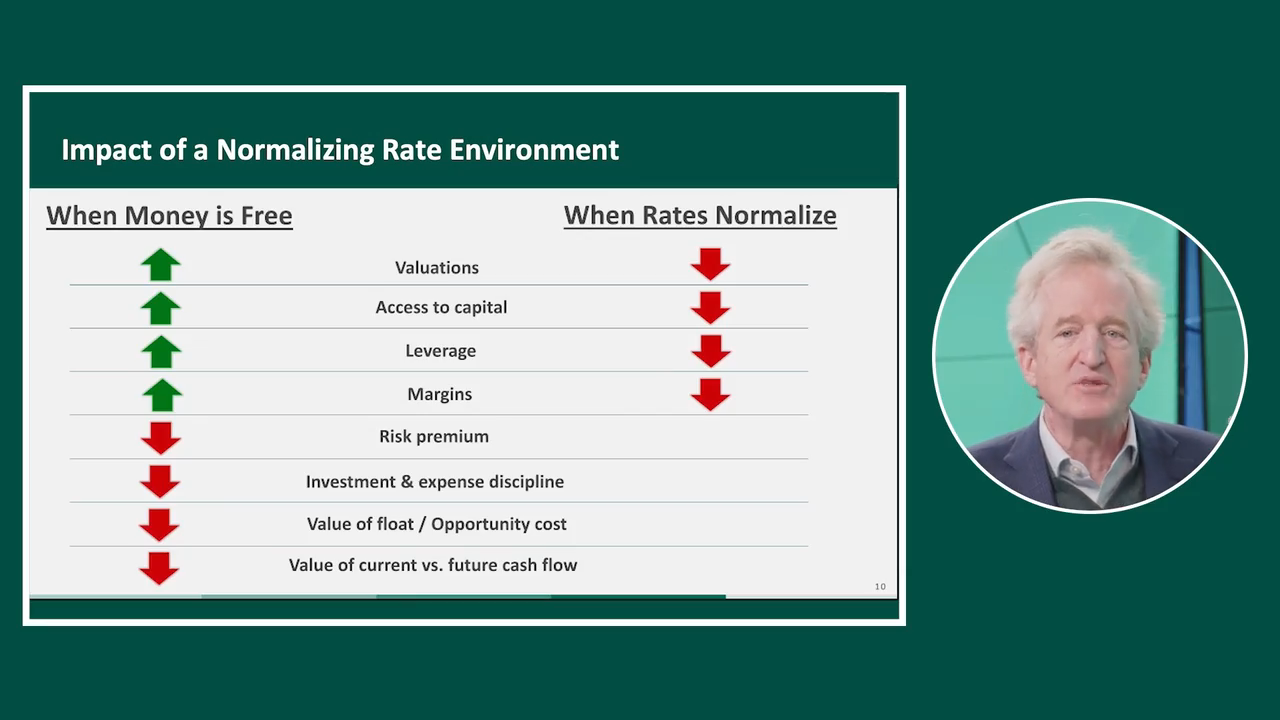

Investor Implications of Rising Rates