More than 60 years of experience has taught us that successful investing requires patience, discipline and the ability to control one’s emotions.

Here are some of the best investment minds in history offering insights on timeless wealthbuilding principles.

“Invest for the long haul. Don’t get too greedy and don’t get too scared.”

Shelby M.C. Davis

“Waiting helps you as an investor and a lot of people just can’t stand to wait. If you didn’t get the deferred-gratification gene, you’ve got to work very hard to overcome that.”

Charlie Munger

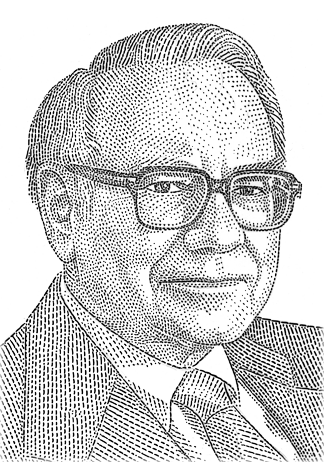

“The stock market is a device to transfer money from the impatient to the patient.”

Warren Buffett

“Thousands of experts study overbought indicators, head-and-shoulder patterns, put-call ratios, the Fed’s policy on money supply…and they can’t predict markets with any useful consistency, any more than the gizzard squeezers could tell the Roman emperors when the Huns would attack.”

Peter Lynch

“The function of economic forecasting is to make astrology look respectable.”

John Kenneth Galbraith

“I make no attempt to forecast the market—my efforts are devoted to finding undervalued securities.”

Warren Buffett

“Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.”

Peter Lynch

“The idea that a bell rings to signal when to get into or out of the stock market is simply not credible. After nearly fifty years in this business, I don’t know anybody who has done it successfully and consistently. I don’t even know anybody who knows anybody who has.”

Jack Bogle

“Though tempting, trying to time the market is a loser’s game. $10,000 continuously invested in the market over the past 20 years grew to $63,636. If you missed just the best 30 days, your investment was reduced to $11,484.1”

Christopher Davis

“History provides a crucial insight regarding market crises: they are inevitable, painful and ultimately surmountable.”

Shelby M.C. Davis

“A 10% decline in the market is fairly common—it happens about once a year. Investors who realize this are less likely to sell in a panic, and more likely to remain invested, benefitting from the wealthbuilding power of stocks.”

Christopher Davis

“In the short run, the market is a voting machine. In the long run, it is a weighing machine.”

Benjamin Graham

“A market downturn doesn’t bother us. It is an opportunity to increase our ownership of great companies with great management at good prices.”

Warren Buffett

“You make most of your money in a bear market, you just don’t realize it at the time.”

Shelby Cullom Davis