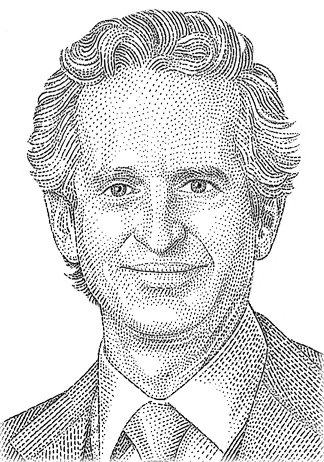

“Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.”

Peter Lynch,

Legendary Investor and Author

Timing the Market is a Loser’s Game

Fear and greed can cause investors to rush in and out of the market at inopportune times.

The Benefit of Staying the Course

$10,000 Investment in the Market

Over the Past 20 Years1

1 The market is represented by S&P 500® Index. Investments cannot be made directly in an index. Past performance is not a guarantee of future results.

Investor Behaviors That

Improve Returns

Disregard Market

Forecasts

Be Patient

Consider Investing

When Feeling Fearful

Don't Jump In & Out of the Market

Tune Out Daily

Market Drama

Work with a Trusted

Financial Advisor

Don’t Try to Time the Market

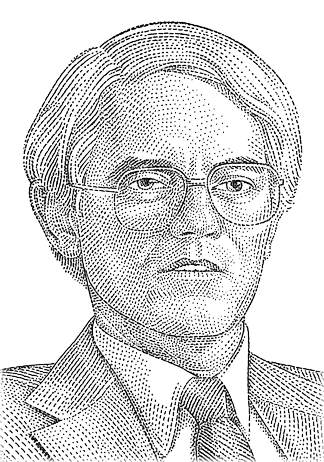

“As stewards of our shareholders’ savings, it is important to share the wisdom we have acquired over more than half a century of investing.”

Chris Davis

Portfolio Manager and Chairman