A True Active ETF With a Full Market-Cycle Track Record

PM Chris Davis on what has helped Davis Select US Equity ETF (DUSA) become one of the top active ETFs in the industry.

PM Chris Davis with David Rubenstein of Carlyle Group

Why all true investing is value investing, the importance of patience, resisting momentum-driven markets, maintaining discipline through volatility.

“The stock market is a device to transfer money from the ‘impatient’ to the ‘patient’.”

Warren Buffett, Chairman, Berkshire Hathaway

Davis Volatility Survival Guide

An illustrated guide to help tune out the noise, make sense of the volatility and build long-term wealth

DUSA (Davis Select US Equity ETF) - Our Actively Managed, Best-Ideas Portfolio

What Drives Stock Selection in the Davis ETFs’ Active Strategies (1:31)

The basic question our PMs ask: “What kind of businesses do you want to own, and how much do you want to pay?”

A Closer Look inside DUSA (6:09)

Dodd Kittsley, CFA & Davis Director of ETFs, discusses investment themes, types of companies, and the attractive growth / low multiple companies populating the portfolio

Incorporating DUSA in a Portfolio Allocation (1:44)

How investors are using DUSA, the types of managers we pair well with in a diversified portfolio allocation

Actively managed. Benchmark agnostic. Intra-day liquidity.

Davis Actively Managed ETFs

| Fund | Expense Ratio (gross/net)1 | Documents |

|---|---|---|

| DUSA Davis Select U.S. Equity ETF | 0.59%/0.59% | |

| DINT Davis Select International ETF | 0.66%/0.66% | |

| DWLD Davis Select Worldwide ETF | 0.62%/0.62% | |

| DFNL Davis Select Financial ETF | 0.61%/0.61% |

PM Reviews

Our Portfolio Managers on the markets and how we are positioning portfolios now to pursue the opportunities being created.

About Davis

Time-Tested True Active Management

With the Traditional Benefits of ETFs

Low cost, tax efficient, transparent

Wisdom of Great Investors

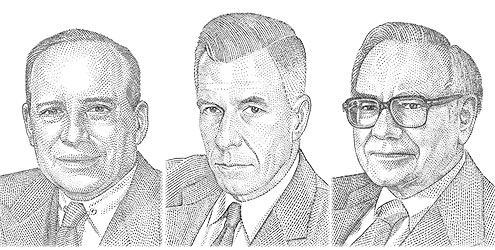

Timeless principles from some of history's most successful investors: Warren Buffett, Ben Graham, Charlie Munger, and others.

Insights & Commentary

Portfolio Manager Reviews

Davis & Goei: Actively Managed ETF Pioneers

Davis Selected Advisers, L.P. has contractually agreed to waive fees and/or reimburse the Funds’ expenses to the extent necessary to cap total annual fund operating expenses as shown until March 1, 2025. After that date, there is no assurance that the Adviser will continue to cap expenses. The expense cap cannot be terminated prior to that date, without the consent of the Board of Trustees.