Our Portfolio Managers on the Markets and New Opportunities

The Return to Rationality

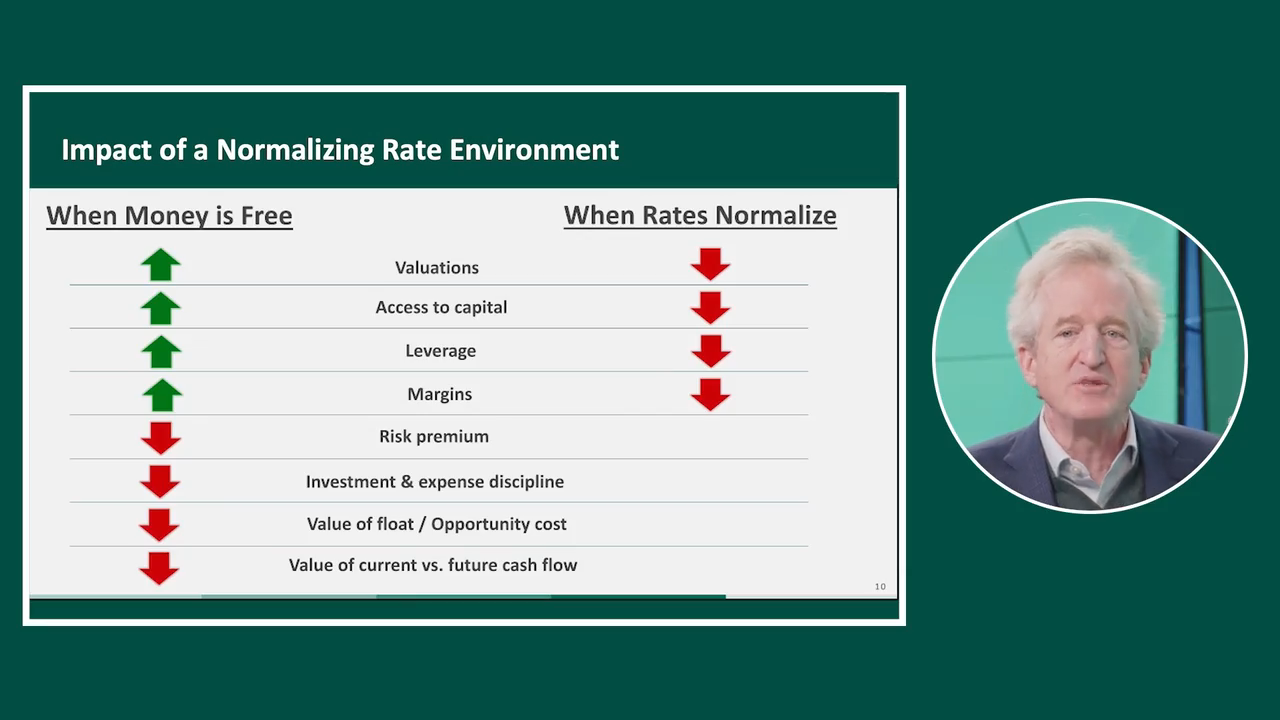

The bursting of the easy money bubble marks a huge transition for the markets

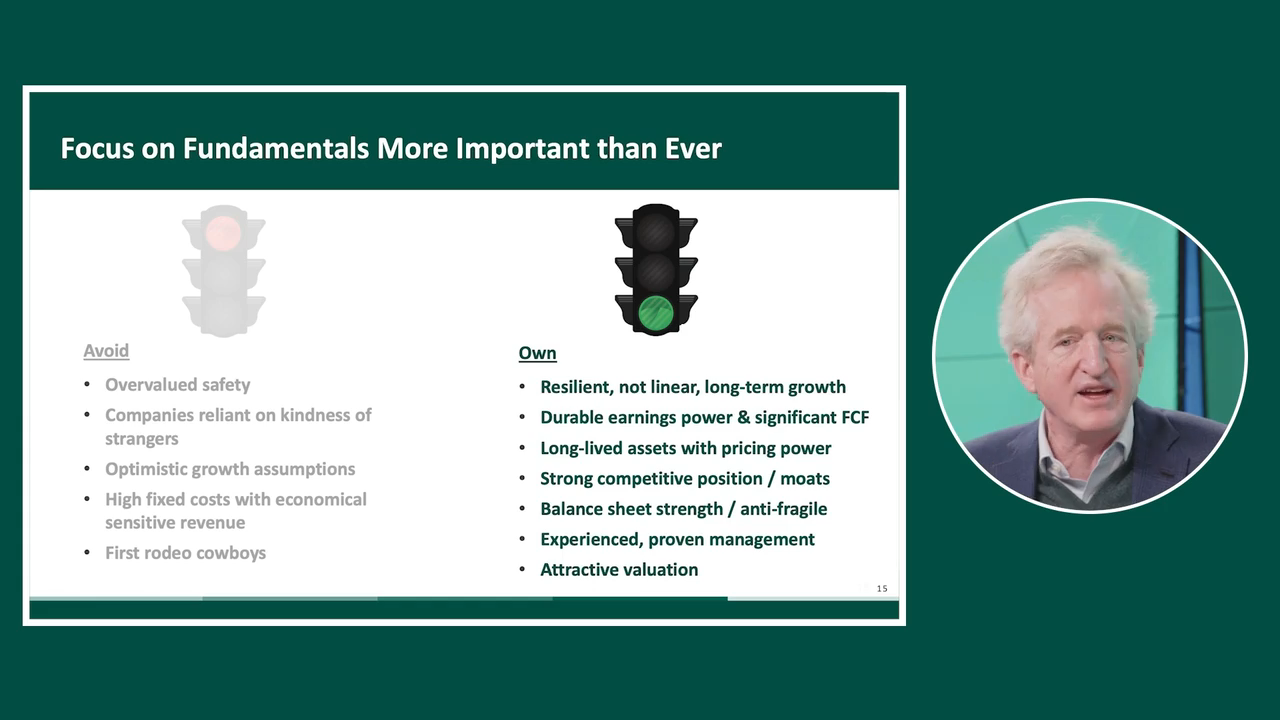

What to Own and Avoid in a Changing Environment

As rates normalize, specific companies attributes may be rewarded or penalized by the markets

Why All Financials are Not Created Equal

“Financials” are often mistakenly lumped together, despite their wildly differed risk and opportunity profiles. The best are being rewarded by investors, but remain undervalued

Investing in a Transitioning Market

The end of the “easy money” era is unwinding the market distortions of the past decade, reinventing the landscape for businesses and investors

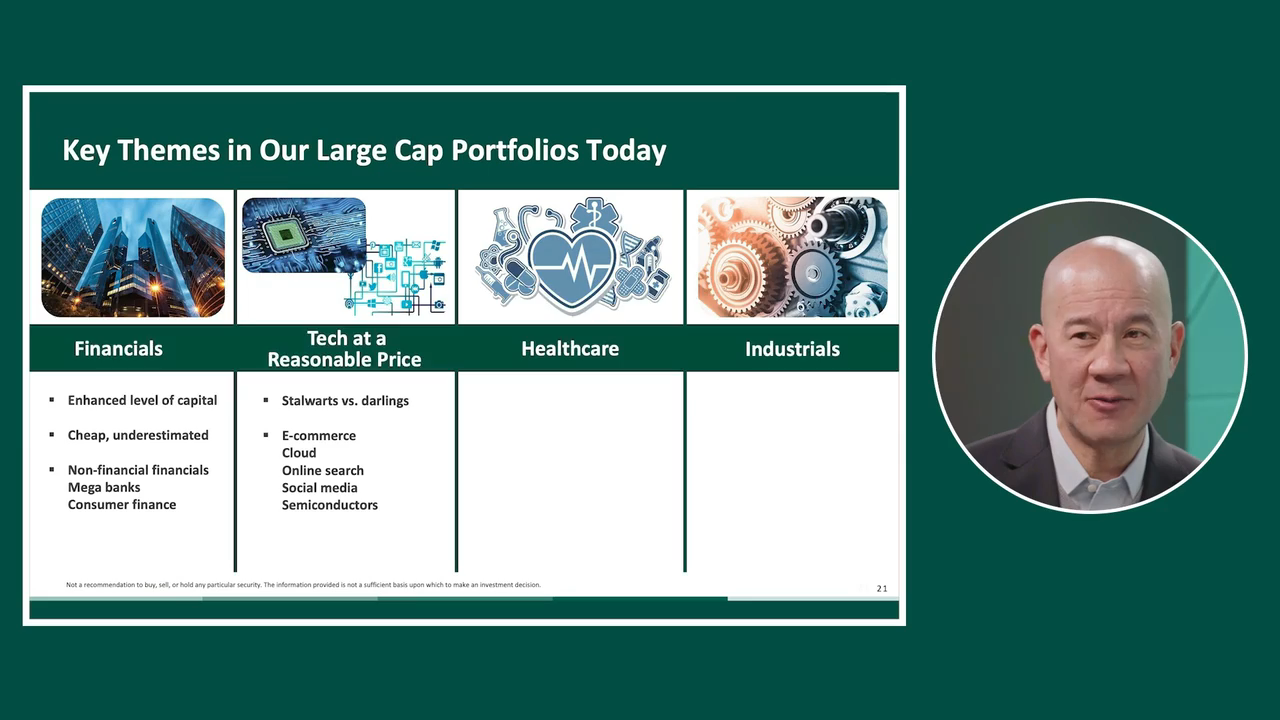

Investment Themes We’re Focusing On Today

Why we’re focusing on select opportunities within Financials, Tech at a reasonable price, Healthcare and Industrials

Tech – The Magnificent 7 and Beyond

Focus on the Tech Stalwarts with reasonable valuations, in addition to the Online Giants

Actively managed. Benchmark agnostic. Intra-day liquidity.

Davis Actively Managed ETFs

| Fund | Expense Ratio (gross/net)1 | Documents |

|---|---|---|

| DUSA Davis Select U.S. Equity ETF | 0.61%/0.61% | |

| DINT Davis Select International ETF | 0.66%/0.66% | |

| DWLD Davis Select Worldwide ETF | 0.63%/0.63% | |

| DFNL Davis Select Financial ETF | 0.64%/0.64% |

Annual PM Reviews 2024

Our Portfolio Managers on the markets and how we are positioning portfolios now to pursue the opportunities being created.

About Davis

Time-Tested True Active Management

With the Traditional Benefits of ETFs

Low cost, tax efficient, transparent

Wisdom of Great Investors

Timeless principles from some of history's most successful investors: Warren Buffett, Ben Graham, Charlie Munger, and others.

Insights & Commentary

Portfolio Manager Reviews

Davis & Goei: Actively Managed ETF Pioneers

Davis Selected Advisers, L.P. has contractually agreed to waive fees and/or reimburse the Funds’ expenses to the extent necessary to cap total annual fund operating expenses as shown until March 1, 2025. After that date, there is no assurance that the Adviser will continue to cap expenses. The expense cap cannot be terminated prior to that date, without the consent of the Board of Trustees.